Your 1099 r life insurance surrender images are available in this site. 1099 r life insurance surrender are a topic that is being searched for and liked by netizens now. You can Get the 1099 r life insurance surrender files here. Get all free vectors.

If you’re looking for 1099 r life insurance surrender pictures information connected with to the 1099 r life insurance surrender keyword, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

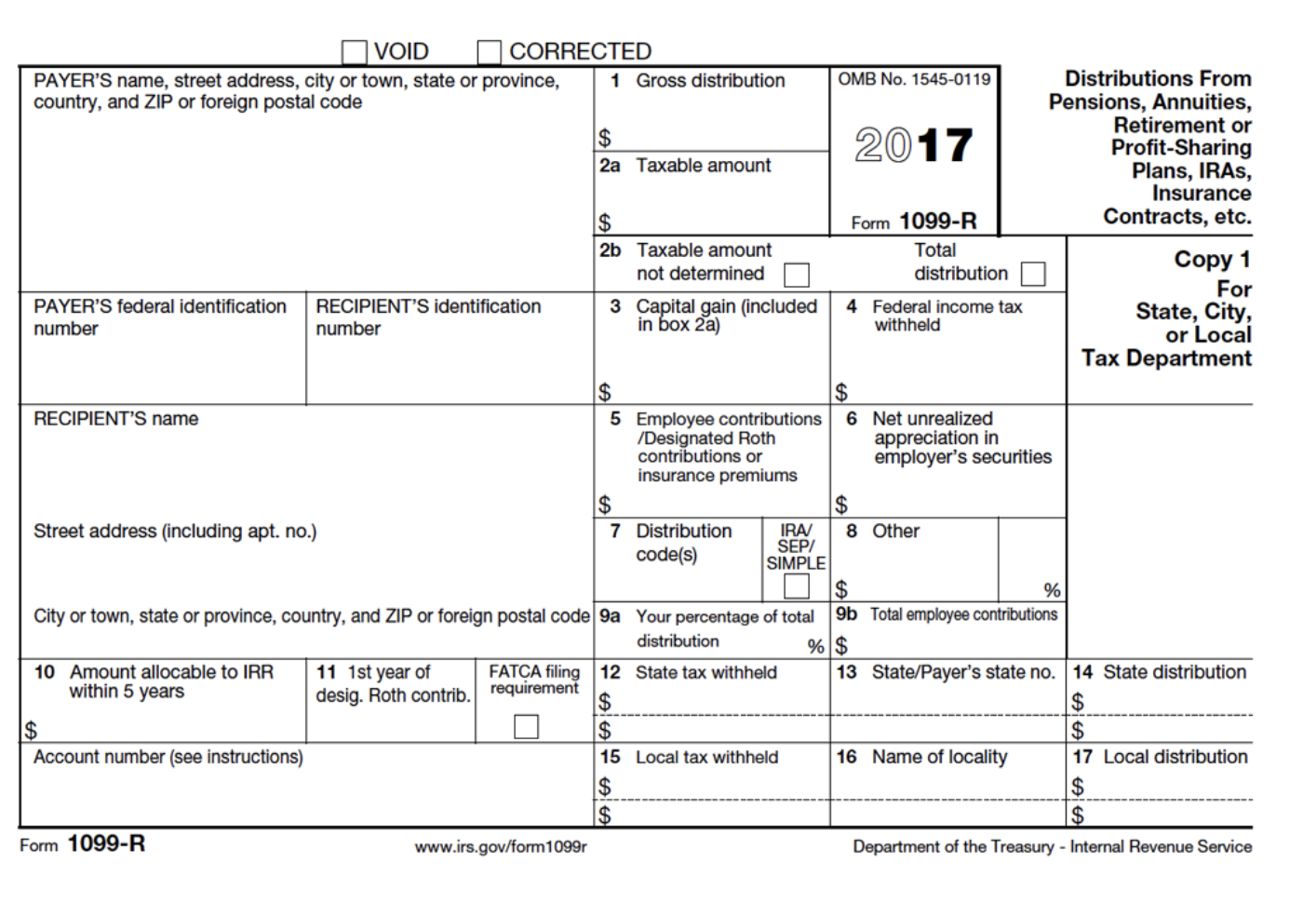

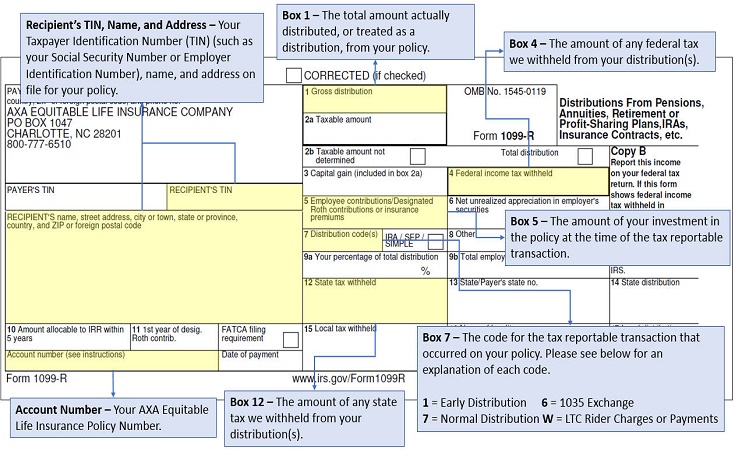

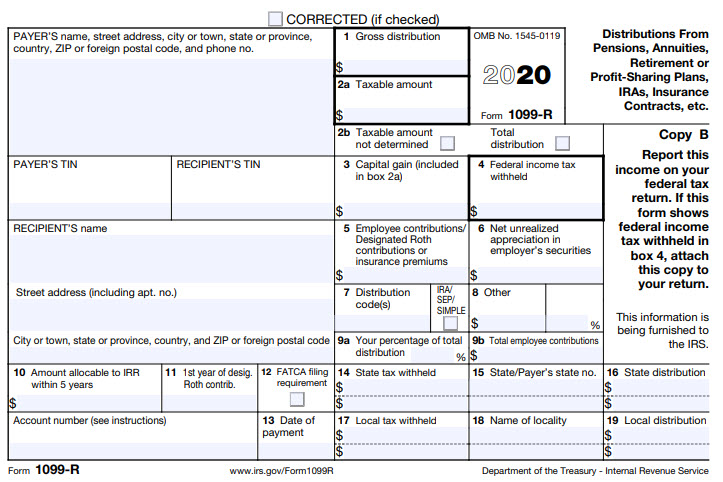

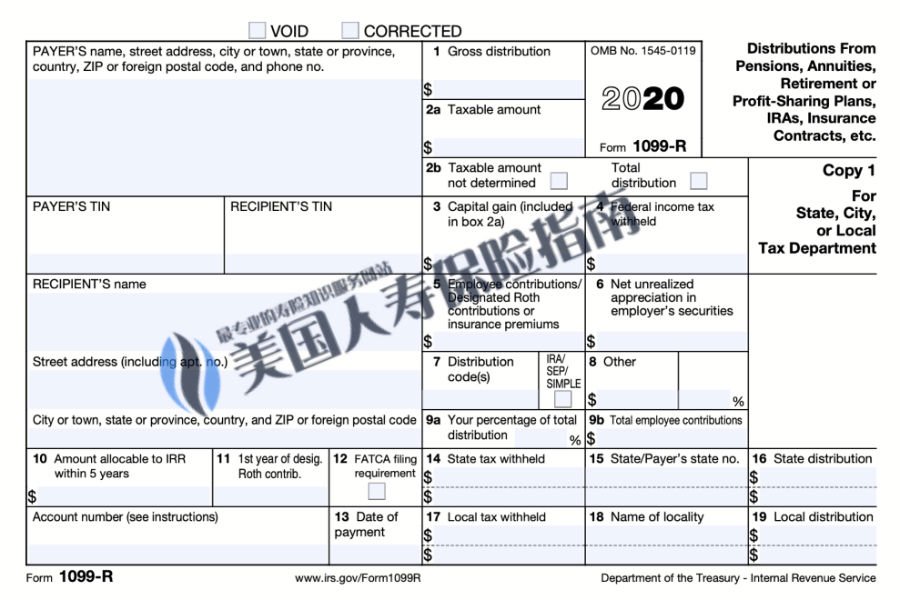

1099 R Life Insurance Surrender. Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. You may have received more than one Form 1099-R if you had reportable transactions from multiple. Are death distributions taxable. If you are reporting the surrender of a life insurance contract see Code 7 later.

Publication 575 Pension And Annuity Income Taxation Of Nonperiodic Payments From jdunman.com

Publication 575 Pension And Annuity Income Taxation Of Nonperiodic Payments From jdunman.com

If an annuity is owned by a non-natural person such as a trust then any gain in the. Not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Life Insurance surrender no 1099-R This was part of Public Law 97-248 that changed annuity and insurance distributions from coming first from your investment in the contract for amounts invested before that August 14 1982 to coming first from taxable earnings on amounts invested after on or after August 14 1982. Box 1 shows the total amount you received from the insurance company 250000. Distributions of 10 or more to a payee for a pre-death distribution from a life insurance contract must be reported on IRS Form 1099-R.

Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient.

The gross amount of the distribution taxable amount employee contributions tax withholding and the distribution code are reported to the contract owner and the IRS. Commissioner TC Memo 2011-183. Download PDF James Ledger et ux. I simply want to point. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. See however Box 1 later for.

Box 1 shows the total amount you received from the insurance company 250000. Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts survivor income benefit plans. If part of the distribution is taxable and part is nontaxable the entire distribution must be reported on IRS Form 1099-R. If you are reporting the surrender of a life insurance contract see Code 7. Taxpayer Recognizes Taxable Income on Surrender of Life Insurance Policy.

Source: 1099fire.com

Source: 1099fire.com

Life Insurance surrender no 1099-R This was part of Public Law 97-248 that changed annuity and insurance distributions from coming first from your investment in the contract for amounts invested before that August 14 1982 to coming first from taxable earnings on amounts invested after on or after August 14 1982. If you are reporting the surrender of a life insurance contract see Code 7 later. Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. From the example above Emanuel could simply take a loan for 200000 and hed have no tax liability. Not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient.

Source: lsa-llc.com

Source: lsa-llc.com

Tax Court concludes that taxpayer recognized taxable income on the surrender of his life insurance policy when the insurance company applied the policys maturity value to the outstanding balance of his policy loans. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Form 1099-R is used to report distributions from accounts such as pensions annuities retirement plans IRAs and insurance contracts. Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts survivor income benefit plans. If you received a Form 1099-R from us you received a reportable transaction from an annuity contract.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

If you are reporting the surrender of a life insurance contract see Code 7 later. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Insurance companies are required to send these forms out whenever something happens to trigger it like a full surrender of a life insurance policy a partial withdrawal a loan or a dividend transaction. Life insurance policyholders can use loans on cash surrender value to avoid taxes without needing to withdraw any money. Commissioner TC Memo 2011-183.

Source: fdocuments.in

Source: fdocuments.in

If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction. Tax Court concludes that taxpayer recognized taxable income on the surrender of his life insurance policy when the insurance company applied the policys maturity value to the outstanding balance of his policy loans. I simply want to point. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. The Mallorys received the Form 1099-R from Monarch Life before the April 15 2012 filing deadline.

Source: communitytax.com

Source: communitytax.com

See however Box 1 later for. If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction. I simply want to point. A 1099-R is an IRS tax form that reports distributions from annuities IRAs retirement plans profit-sharing plans pensions and insurance contracts. If an annuity is owned by a non-natural person such as a trust then any gain in the.

Source: fdocuments.in

Source: fdocuments.in

See however Box 1 later for FFIs reporting in a manner similar to section. Not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts survivor income benefit plans. Tax Court concludes that taxpayer recognized taxable income on the surrender of his life insurance policy when the insurance company applied the policys maturity value to the outstanding balance of his policy loans. Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient.

Source: equitable.com

Source: equitable.com

If you are reporting the surrender of a life insurance contract see Code 7 later. A 1099-R is an IRS tax form that reports distributions from annuities IRAs retirement plans profit-sharing plans pensions and insurance contracts. The Mallorys received the Form 1099-R from Monarch Life before the April 15 2012 filing deadline. If you are reporting the surrender of a life insurance contract see. What is a 1099-R.

Source: eagle-lifeco.com

Source: eagle-lifeco.com

Tax Court concludes that taxpayer recognized taxable income on the surrender of his life insurance policy when the insurance company applied the policys maturity value to the outstanding balance of his policy loans. Life Insurance surrender no 1099-R This was part of Public Law 97-248 that changed annuity and insurance distributions from coming first from your investment in the contract for amounts invested before that August 14 1982 to coming first from taxable earnings on amounts invested after on or after August 14 1982. Form 1099-R is used to report distributions from accounts such as pensions annuities retirement plans IRAs and insurance contracts. Listed below are a few scenarios for which a Form 1099-R might be generated. Tax Court concludes that taxpayer recognized taxable income on the surrender of his life insurance policy when the insurance company applied the policys maturity value to the outstanding balance of his policy loans.

Source: lsa-llc.com

Source: lsa-llc.com

If you are reporting the surrender of a life insurance contract see Code 7 later. If you are reporting the surrender of a life insurance contract see Code 7 later. Life insurance policyholders can use loans on cash surrender value to avoid taxes without needing to withdraw any money. If you received a Form 1099-R from us you received a reportable transaction from an annuity contract. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient.

If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of the contract to a new owner. A 1099-R is an IRS tax form that reports distributions from annuities IRAs retirement plans profit-sharing plans pensions and insurance contracts. Tax Court concludes that taxpayer recognized taxable income on the surrender of his life insurance policy when the insurance company applied the policys maturity value to the outstanding balance of his policy loans. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Commissioner TC Memo 2011-183.

Source: lsa-llc.com

Source: lsa-llc.com

Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. The Mallorys received the Form 1099-R from Monarch Life before the April 15 2012 filing deadline. Are death distributions taxable. If you are reporting the surrender of a life insurance contract see Code 7. If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

An inheritance is not subject to income taxes. Life Insurance surrender no 1099-R This was part of Public Law 97-248 that changed annuity and insurance distributions from coming first from your investment in the contract for amounts invested before that August 14 1982 to coming first from taxable earnings on amounts invested after on or after August 14 1982. Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction. Box 1 shows the total amount you received from the insurance company 250000.

Source: thelifetank.com

Source: thelifetank.com

If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of the contract to a new owner. Taxpayer Recognizes Taxable Income on Surrender of Life Insurance Policy. Download PDF James Ledger et ux. Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts survivor income benefit plans. From the example above Emanuel could simply take a loan for 200000 and hed have no tax liability.

Source: jdunman.com

Source: jdunman.com

A 1099-R is simply a form that is sent out because of a potentially taxable event. If you received a Form 1099-R from us you received a reportable transaction from an annuity contract. Download PDF James Ledger et ux. Box 1 shows the total amount you received from the insurance company 250000. See however Box 1 later for.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Life Insurance surrender no 1099-R This was part of Public Law 97-248 that changed annuity and insurance distributions from coming first from your investment in the contract for amounts invested before that August 14 1982 to coming first from taxable earnings on amounts invested after on or after August 14 1982. If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of the contract to a new owner. From the example above Emanuel could simply take a loan for 200000 and hed have no tax liability. If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction. An inheritance is not subject to income taxes.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. Are death distributions taxable. Download PDF James Ledger et ux. What is a 1099-R. From the example above Emanuel could simply take a loan for 200000 and hed have no tax liability.

Source: thelink.ascensus.com

Source: thelink.ascensus.com

If you are reporting the surrender of a life insurance contract see Code 7 later. FFIs reporting in a manner similar to section 6047d for chapter 4 purposes. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. A 1099-R is an IRS tax form that reports distributions from annuities IRAs retirement plans profit-sharing plans pensions and insurance contracts. An inheritance is not subject to income taxes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1099 r life insurance surrender by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.