Your Golden cross stocks meaning images are available in this site. Golden cross stocks meaning are a topic that is being searched for and liked by netizens now. You can Download the Golden cross stocks meaning files here. Find and Download all royalty-free photos and vectors.

If you’re looking for golden cross stocks meaning pictures information linked to the golden cross stocks meaning keyword, you have visit the right blog. Our website always gives you hints for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

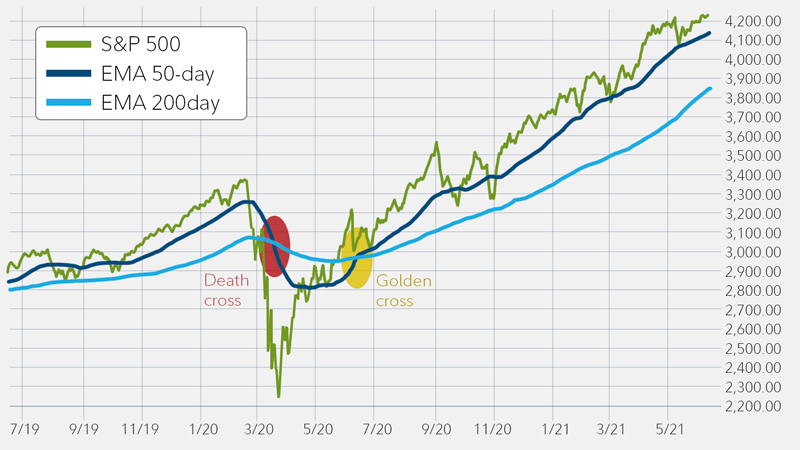

Golden Cross Stocks Meaning. A golden cross indicates a long-term bull market going forward while a death cross signals a long-term bear market. Thus traders and investors expect the previously falling market to begin a long term rising trend. Its the Golden Cross on the stock price chart. That just happened with RPM International which is trading around 9644 at.

How To Use A Moving Average To Buy Stocks From investopedia.com

How To Use A Moving Average To Buy Stocks From investopedia.com

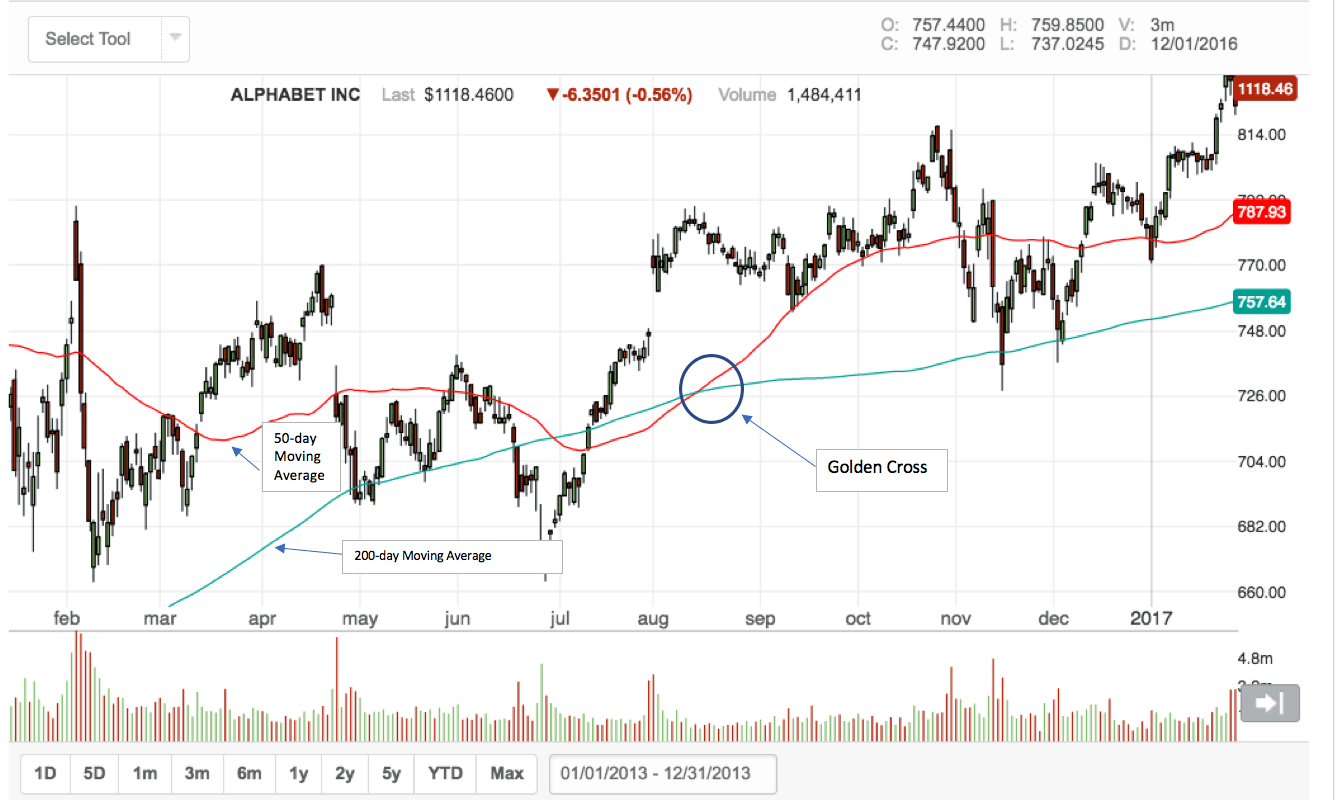

In trading a golden cross is a price chart pattern based on the relationship between a short term moving average and a longer term moving average. A golden cross is a telltale sign of bullish sentiment for a stock and sometimes for the economy as a whole. This could mean the long-term trend is changing. The golden cross occurs when the 50-day crosses above the 200-day. The strategy goes long when the faster SMA 50 the simple moving average of the last 50 bars crosses above the slower SMA 200. A golden cross indicates a long-term bull market going forward while a death cross signals a long-term bear market.

Whats a Golden Cross.

Golden Cross SMA 200 Moving Average Strategy by ChartArt This famous moving average strategy is very easy to follow to decide when to buy go long and when to take profit. Thus investors who watch technical trading charts tend to buy a stock when the short-term moving average rises above the long-term moving average and they tend to sell when the short-term moving average falls below the long-term moving. How do you know if investors are bullish on a stock. The idea behind a golden cross is that if an investments. That just happened with RPM International which is trading around 9644 at. A golden cross is a telltale sign of bullish sentiment for a stock and sometimes for the economy as a whole.

Source: pinterest.com

Source: pinterest.com

The death cross has all kinds of ramifications and its a strong bearish signal that has lead in the past to the stock market crash. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. How do you know if investors are bullish on a stock. This indicates a bullish shift in sentiments. A bullish signal generated when the 50-dayshort-term moving average crosses above the 200-daylong-term moving average.

Source: ig.com

Source: ig.com

This indicates a bullish shift in sentiments. In trading a golden cross is a price chart pattern based on the relationship between a short term moving average and a longer term moving average. That just happened with HSBC Holdings which is trading around 2892 at. Golden cross stocks are considered to have a bullish breakout signal. Investors like this calculation because it strips out the intra-day volatility of a share price noise to give a fixed trend that can be tracked over a given time frame.

Source: businessyield.com

Source: businessyield.com

This is typically a telltale sign of bullish sentiment for a stock reinforced by high. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above. A golden cross is a telltale sign of bullish sentiment for a stock and sometimes for the economy as a whole. When a golden cross forms it signals that a new bull trend is in the process of forming so as a trend trader you will want to use this as an opportunity to look to buy dips into support in order to jump on board the new trend and extract maximum profit. A golden cross indicates a long-term bull market going forward while a death cross signals a long-term bear market.

Source: investopedia.com

Source: investopedia.com

It is a solid bullish price direction that works well with most crypto trading assets. The golden cross occurs when the 50-day crosses above the 200-day. In trading a golden cross is a price chart pattern based on the relationship between a short term moving average and a longer term moving average. This indicates a bullish shift in sentiments. In the trading world a Golden Cross occurs when the 50 day moving average rises above its 200 day average.

Source: pinterest.com

Source: pinterest.com

This could mean the long-term trend is changing. The death cross stock trade occurs when the 50- day moving average crosses over the 200-day moving average. Golden cross stocks are considered to have a bullish breakout signal. The golden cross occurs when the 50-day crosses above the 200-day. That just happened with RPM International which is trading around 9644 at.

Source: investopedia.com

Source: investopedia.com

However no downtrend lasts forever. A golden cross is a telltale sign of bullish sentiment for a stock and sometimes for the economy as a whole. The death cross has all kinds of ramifications and its a strong bearish signal that has lead in the past to the stock market crash. A Golden Cross is when a stocks 50 day moving average crosses above the 200 day moving average. However no downtrend lasts forever.

Source: investopedia.com

Source: investopedia.com

Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above. Meaning of Golden Cross Stock. The death cross has all kinds of ramifications and its a strong bearish signal that has lead in the past to the stock market crash. The idea behind a golden cross is that if an investments. Death crosses are the opposite of golden crosses.

Source: flowbank.com

Source: flowbank.com

Death crosses are the opposite of golden crosses. This could mean the long-term trend is changing. Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up. That just happened with HSBC Holdings which is trading around 2892 at. The idea behind a golden cross is that if an investments.

Source: pinterest.com

Source: pinterest.com

In the last stage the short-term moving average continues to move upward. How do you know if investors are bullish on a stock. The death cross stock trade occurs when the 50- day moving average crosses over the 200-day moving average. A golden cross indicates a long-term bull market going forward while a death cross signals a long-term bear market. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above.

Source: pinterest.com

Source: pinterest.com

It is a solid bullish price direction that works well with most crypto trading assets. A golden cross indicates a long-term bull market going forward while a death cross signals a long-term bear market. In the trading world a Golden Cross occurs when the 50 day moving average rises above its 200 day average. A golden cross is a telltale sign of bullish sentiment for a stock and sometimes for the economy as a whole. This occurs when a short-term moving average such as the 50-day MA sharply rises and crosses over the longer-term moving average such as the 200-day MA.

Thats where the term golden cross comes from when the two average lines cross on a chart. Its the Golden Cross on the stock price chart. Thats where the term golden cross comes from when the two average lines cross on a chart. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above. The death cross has all kinds of ramifications and its a strong bearish signal that has lead in the past to the stock market crash.

Source: pinterest.com

Source: pinterest.com

Thus investors who watch technical trading charts tend to buy a stock when the short-term moving average rises above the long-term moving average and they tend to sell when the short-term moving average falls below the long-term moving. This is seen as bullish. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. Death crosses are the opposite of golden crosses. A golden cross could be said to be a bullish moving average breakout where the long term period moving average becomes the resistance level thats breached by the shorter period moving average.

Source: pinterest.com

Source: pinterest.com

How do you know if investors are bullish on a stock. This indicates a bullish shift in sentiments. A golden cross happens when a short-term moving average crosses over a long-term moving average MA toward the upside. Meaning of Golden Cross Stock. Investors like this calculation because it strips out the intra-day volatility of a share price noise to give a fixed trend that can be tracked over a given time frame.

Source: pinterest.com

Source: pinterest.com

Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above. However no downtrend lasts forever. The idea behind a golden cross is that if an investments. A golden cross indicates a long-term bull market going forward while a death cross signals a long-term bear market. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above.

Source: fidelity.com

Source: fidelity.com

It is a solid bullish price direction that works well with most crypto trading assets. Meaning of Golden Cross Stock. Thats where the term golden cross comes from when the two average lines cross on a chart. However no downtrend lasts forever. The death cross has all kinds of ramifications and its a strong bearish signal that has lead in the past to the stock market crash.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Thats where the term golden cross comes from when the two average lines cross on a chart. Thats where the term golden cross comes from when the two average lines cross on a chart. Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above. Investors like this calculation because it strips out the intra-day volatility of a share price noise to give a fixed trend that can be tracked over a given time frame.

Source: investopedia.com

Source: investopedia.com

Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up. This list is generated daily ranked based on market cap and limited to the top 30 stocks that meet. A Golden Cross is when a stocks 50 day moving average crosses above the 200 day moving average. In the trading world a Golden Cross occurs when the 50 day moving average rises above its 200 day average. A bullish signal generated when the 50-dayshort-term moving average crosses above the 200-daylong-term moving average.

Source: pinterest.com

Source: pinterest.com

In the trading world a Golden Cross occurs when the 50 day moving average rises above its 200 day average. The original golden cross trading strategy has its origins in the stock market. How do you know if investors are bullish on a stock. Thus traders and investors expect the previously falling market to begin a long term rising trend. Usually calculated by comparing a 50-day to a 200-day moving average golden crosses are interpreted to mean that a stock is going up.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title golden cross stocks meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.