Your How to calculate return on invested capital images are available. How to calculate return on invested capital are a topic that is being searched for and liked by netizens now. You can Get the How to calculate return on invested capital files here. Get all free images.

If you’re looking for how to calculate return on invested capital pictures information related to the how to calculate return on invested capital topic, you have come to the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

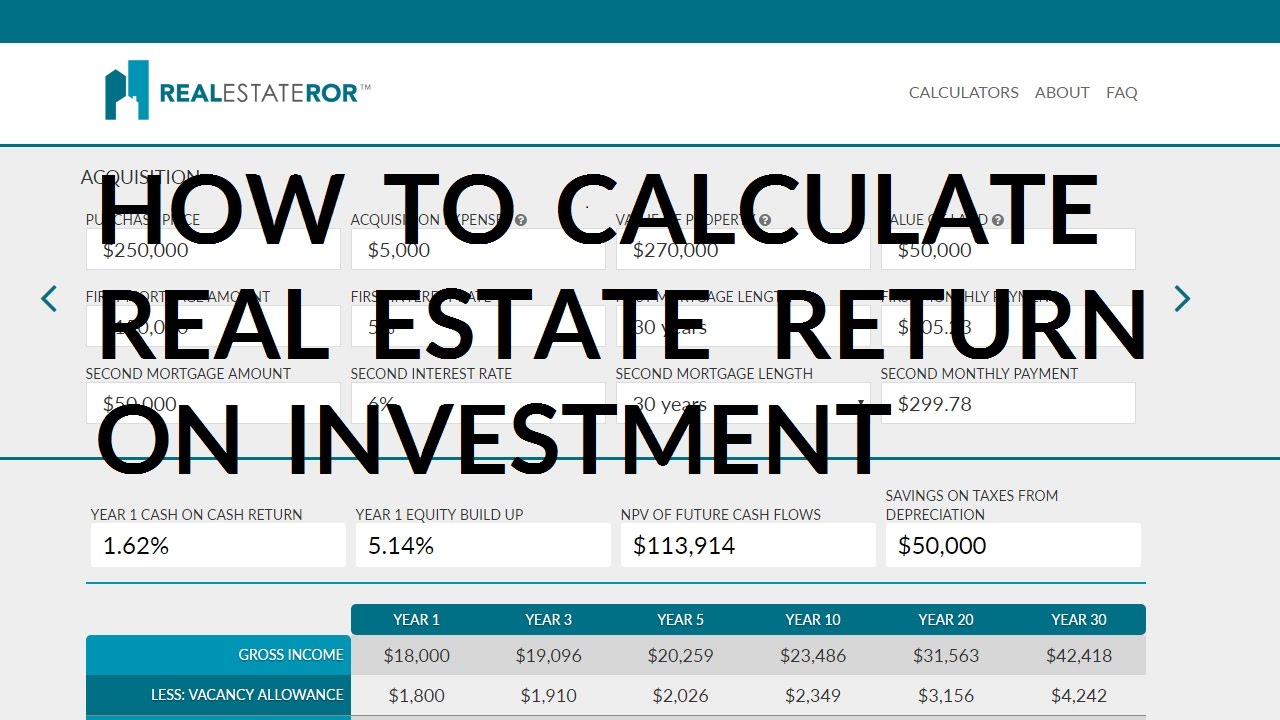

How To Calculate Return On Invested Capital. The formula for ROI is Net Profit Total Investment 100 ROI. Return on Invested Capital ROIC is a profitability or performance measure of the return earned by those who provide capital namely the firms bondholders and stockholders. To calculate the invested capital portion of the formula we. 190 10 100 100 200.

How To Calculate The Roi For Your Social Media Channels Infographic Marketing Strategy Social Media Social Media Roi Social Media Marketing Campaign From pinterest.com

How To Calculate The Roi For Your Social Media Channels Infographic Marketing Strategy Social Media Social Media Roi Social Media Marketing Campaign From pinterest.com

Invested Capital 8857 38129 88877. NOPAT is typically used in the numerator because it captures the recurring core operating profits and is an unlevered measure ie. 190 10 100 100 200. Understanding Return on Invested Capital. Invested Capital Short-term debt Long-term debt Total Shareholders Equity. A companys ROIC is often compared to its WACC to determine whether the company is creating or destroying value.

An implication surrounding the use of time-series data in which the final statistical conclusion can change based on.

It can be used to show investors or capital contributors how well the company is doing at turning invested capital into profit. Calculating the ROIC for a Company. Therefore knowing how to calculate and analyze return on invested capital is crucial for investors looking to value stocks and benefit from long-term stock price appreciation. 180 120 300 300 300. Return on Invested Capital and WACC If the ROIC is greater than the WACC then value is being created as the firm invests in profitable projects. Some use earnings or some measure of bottom line cash flow divided by total debt and equity.

Source: pinterest.com

Source: pinterest.com

The primary reason for comparing a firms return on invested capital to its weighted average cost of capital WACC WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. Some like Joel Greenblatt want to know how much tangible capital a business uses so they define ROIC as earnings or sometimes pretax earnings before interest payments. What is the formula for return on invested capital. The formula for ROI is Net Profit Total Investment 100 ROI. A companys return on invested capital can be calculated by using the following formula.

Source: pinterest.com

Source: pinterest.com

Invested Capital Short-term debt Long-term debt Total Shareholders Equity. Invested Capital 135863. As you can see youre going to need three pieces of information. 190 10 100 100 200. NOPAT is typically used in the numerator because it captures the recurring core operating profits and is an unlevered measure ie.

Source: pinterest.com

Source: pinterest.com

Now that we have all the values lets us calculate the ROIC for both the companies. Understanding Return on Invested Capital. Invested Capital Short-term debt Long-term debt Total Shareholders Equity. Return on Invested Capital NOPAT Invested Capital 100. Return on Invested Capital and WACC.

Source: pinterest.com

Source: pinterest.com

As you can see youre going to need three pieces of information. Calculating the ROIC for a Company. Return on Invested Capital and WACC If the ROIC is greater than the WACC then value is being created as the firm invests in profitable projects. A companys return on invested capital can be calculated by using the following formula. Unlike IRR another performance measure MOIC focuses on how much rather than when meaning that MOIC does not take into account the time it takes to achieve that level of returns and just.

Source: pinterest.com

Source: pinterest.com

If the ROIC is greater than the. The primary reason for comparing a firms return on invested capital to its weighted average cost of capital WACC WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. It is also one of the more overlooked but useful financial ratios for businesses and investors alike. An implication surrounding the use of time-series data in which the final statistical conclusion can change based on. Return on Invested Capital and WACC If the ROIC is greater than the WACC then value is being created as the firm invests in profitable projects.

Source: pinterest.com

Source: pinterest.com

I like to combine shareholder equity and total debt and net out cash and near-cash on the balance sheet. If the ROIC is greater than the. The goal of calculating return on capital is to determine how profitable a companys operations are. Invested Capital 8857 38129 88877. Using the same formula over time will also illustrate whether a companys performance is staying the same.

Source: pinterest.com

Source: pinterest.com

The formula for calculating return on invested capital is ROIC Net Income - Dividends Total Capital. 180 120 300 300 300. Return on Incremental Invested Capital. By comparing profit generated with the total money spent on resources to achieve that profit a return on invested capital ROIC can be established. The primary reason for comparing a firms return on invested capital to its weighted average cost of capital WACC WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt.

Source: in.pinterest.com

Source: in.pinterest.com

Understanding Return on Invested Capital. Multiple on Invested Capital MOIC is an important performance metric often calculated at the deal or portfolio level to estimate the returns both realized or unrealized of the investments. Now lets put together the two parts of the formula we calculated. A companys return on invested capital can be calculated by using the following formula. Return on Invested Capital and WACC.

Source: in.pinterest.com

Source: in.pinterest.com

It can be used to show investors or capital contributors how well the company is doing at turning invested capital into profit. The return on invested capital ROIC formula is one of the more advanced profitability ratios used in the financial analysis of a business. How to calculate return on investment for new equipment. NOPAT is typically used in the numerator because it captures the recurring core operating profits and is an unlevered measure ie. As you can see youre going to need three pieces of information.

Source: pinterest.com

Source: pinterest.com

I like to combine shareholder equity and total debt and net out cash and near-cash on the balance sheet. What is the formula for return on invested capital. Unlike IRR another performance measure MOIC focuses on how much rather than when meaning that MOIC does not take into account the time it takes to achieve that level of returns and just. If the ROIC is greater than the. Return on invested capital ROIC is a calculation used to assess a companys efficiency at allocating the capital under its control to profitable investments.

Source: pinterest.com

Source: pinterest.com

Conversely if the ROIC is lower than the WACC then value is being destroyed as the firm earns a return on its projects that is lower than the cost of funding the projects. The return on invested capital ROIC formula is one of the more advanced profitability ratios used in the financial analysis of a business. Return on Incremental Invested Capital. However the ROIC figure you find may differ as some websites use a profit figure from the income statement instead of a cash figure which value investors may prefer. 190 10 100 100 200.

Source: pinterest.com

Source: pinterest.com

By comparing profit generated with the total money spent on resources to achieve that profit a return on invested capital ROIC can be established. The formula for ROI is Net Profit Total Investment 100 ROI. 190 10 100 100 200. The return on invested capital ROIC formula is one of the more advanced profitability ratios used in the financial analysis of a business. Calculating the ROIC for a Company.

Source: in.pinterest.com

Source: in.pinterest.com

190 10 100 100 200. A companys ROIC is often compared to its WACC to determine whether the company is creating or destroying value. Invested Capital Short-term debt Long-term debt Total Shareholders Equity. The formula for calculating the return on invested capital consists of dividing the net operating profit after tax by the amount of invested capital. What is the formula for return on invested capital.

Source: pinterest.com

Source: pinterest.com

A companys return on invested capital can be calculated by using the following formula. Return on Invested Capital and WACC. The formula for calculating return on invested capital is ROIC Net Income - Dividends Total Capital. Therefore knowing how to calculate and analyze return on invested capital is crucial for investors looking to value stocks and benefit from long-term stock price appreciation. Unlike IRR another performance measure MOIC focuses on how much rather than when meaning that MOIC does not take into account the time it takes to achieve that level of returns and just.

Source: pinterest.com

Source: pinterest.com

NOPAT is typically used in the numerator because it captures the recurring core operating profits and is an unlevered measure ie. The primary reason for comparing a firms return on invested capital to its weighted average cost of capital WACC WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. The formula for calculating return on invested capital is ROIC Net Income - Dividends Total Capital. To calculate the invested capital portion of the formula we. Calculating the ROIC for a Company.

Source: hu.pinterest.com

Source: hu.pinterest.com

Some use earnings or some measure of bottom line cash flow divided by total debt and equity. To calculate the invested capital portion of the formula we. Invested Capital 135863. What is the formula for return on invested capital. Return on Invested Capital and WACC.

Source: br.pinterest.com

Source: br.pinterest.com

The goal of calculating return on capital is to determine how profitable a companys operations are. 180 120 300 300 300. The goal of calculating return on capital is to determine how profitable a companys operations are. An implication surrounding the use of time-series data in which the final statistical conclusion can change based on. It can be used to show investors or capital contributors how well the company is doing at turning invested capital into profit.

Source: in.pinterest.com

Source: in.pinterest.com

Understanding Return on Invested Capital. 190 10 100 100 200. Unlike IRR another performance measure MOIC focuses on how much rather than when meaning that MOIC does not take into account the time it takes to achieve that level of returns and just. So if you make a new profit of 50000 and spent 200000 on new equipment the ROI is 50000 200000 100 25 ROI. Multiple on Invested Capital MOIC is an important performance metric often calculated at the deal or portfolio level to estimate the returns both realized or unrealized of the investments.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to calculate return on invested capital by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.