Your Irs golden state stimulus 2 images are ready in this website. Irs golden state stimulus 2 are a topic that is being searched for and liked by netizens today. You can Download the Irs golden state stimulus 2 files here. Find and Download all royalty-free photos.

If you’re searching for irs golden state stimulus 2 pictures information linked to the irs golden state stimulus 2 topic, you have come to the ideal site. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Irs Golden State Stimulus 2. California operates under a progressive tax schedule meaning the more you. Here is everything you need to be or do to qualify for the second round of California stimulus checks. To qualify you must have. It is also not an unemployment insurance benefit.

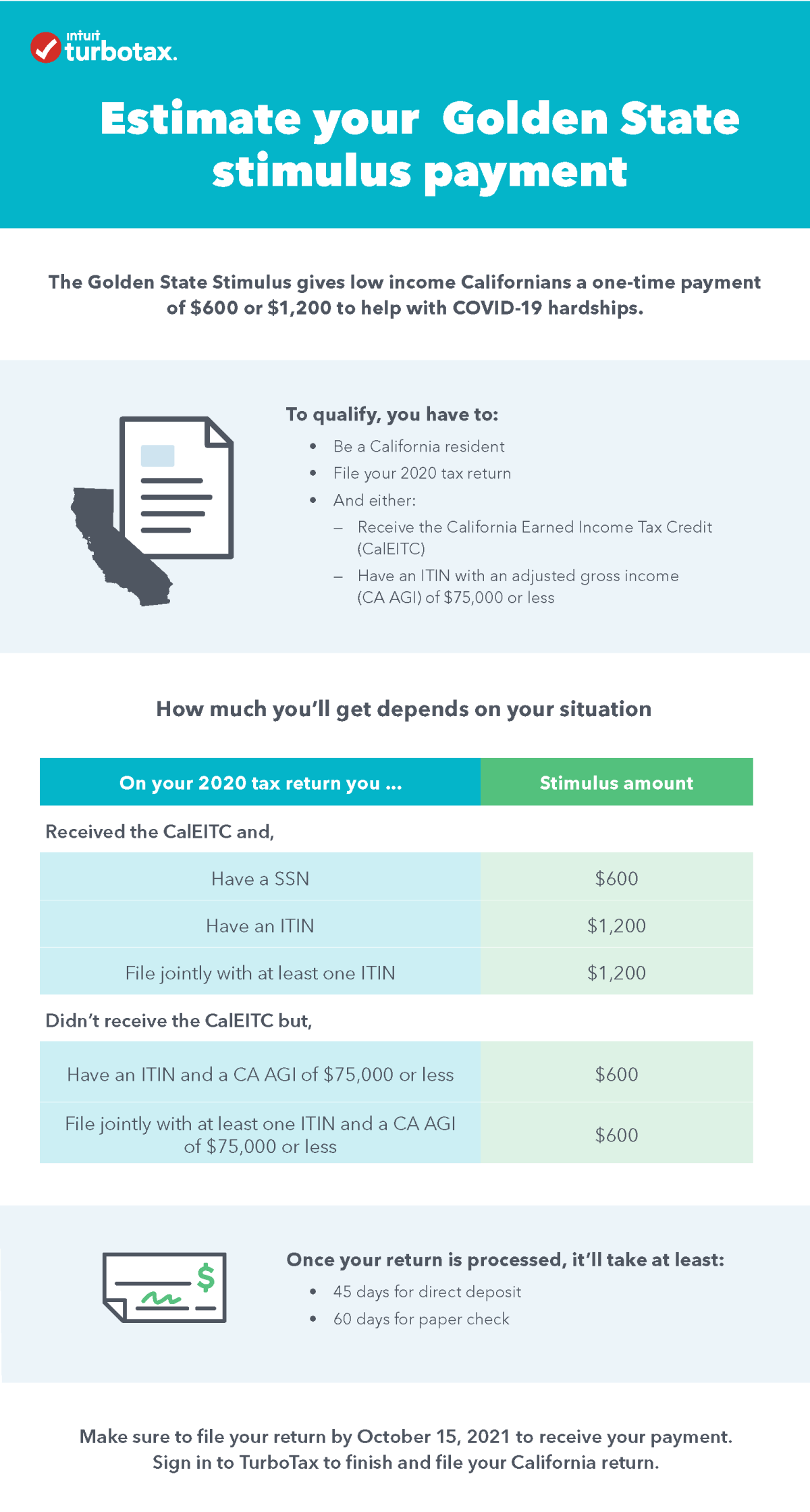

California Golden State Stimulus Turbotax Tax Tips Videos From turbotax.intuit.com

California Golden State Stimulus Turbotax Tax Tips Videos From turbotax.intuit.com

Next you must have a California adjusted gross income of 1 to 75000. To qualify you must have. CALIFORNIANS are getting two more rounds of stimulus checks before Christmas worth up to 1100 each. On November 29 California began to mail out 800000 paper checks under the Golden State Stimulus II. Here is everything you need to be or do to qualify for the second round of California stimulus checks. Check if you qualify for the Golden State Stimulus II.

2 600 payment to qualified ITIN filers making 75000 or less.

Golden State Stimulus 2 status question. Every effort has been made to offer the most correct information possible. The key details of the California stimulus check are that all those who make below 75000 will get one 600 stimulus check per tax return filed. Golden State Stimulus 2 Qualified Families and Individual residents of California will receive 600 to 1200. 1 600 payment to taxpayers with a Social Security Number who qualified for CalEITC making 30000 or less. The poster disclaims any legal responsibility for the accuracy of the.

Source: en.as.com

Source: en.as.com

Stimulus payments are not taxable. SACRAMENTO Tomorrow August 27 Californians will begin receiving the second round of Golden State Stimulus payments the historic 12 billion state tax rebate program enacted by Governor Gavin Newsom to provide direct relief for Californians hit hardest by the pandemic and support the states economic recovery. 600 payments will be made to qualified taxpayers with a Social Security number an Adjusted Gross Income AGI between 1. You can receive both this grant and the Golden State Stimulus if you qualify. Heres what you should know about the Golden State Stimulus II program.

Source: pe.com

Source: pe.com

On November 29 the state will begin to mail out more paper checks which will be followed with another. 3 1200 payment to qualified ITIN filers who also qualified for CalEITC. Another Golden State stimulus check could be heading to Californians next year due to 1970s law Californians to see stimulus boost in 2022 thanks to tax loophole heres how you could get more cash in golden state Child tax credit 2021 update Last 3 Could Evergrande debt default in China cause crypto markets to crash. You may receive this payment if. AROUND 803000 more stimulus checks are going out to Californians this week - with the payments worth 563million in total.

Source: en.as.com

Source: en.as.com

First to be eligible you must have filed your 2020 taxes. 600 payments will be made to qualified taxpayers with a Social Security number an Adjusted Gross Income AGI between 1. Another Golden State stimulus check could be heading to Californians next year due to 1970s law Californians to see stimulus boost in 2022 thanks to tax loophole heres how you could get more cash in golden state Child tax credit 2021 update Last 3 Could Evergrande debt default in China cause crypto markets to crash. California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. 2 600 payment to qualified ITIN filers making 75000 or less.

Source: americanpost.news

Source: americanpost.news

On November 29 the state will begin to mail out more paper checks which will be followed with another. CALIFORNIANS are getting two more rounds of stimulus checks before Christmas worth up to 1100 each. Golden State Stimulus I. Visit Golden State Grant Program California Department of Social Services website for more information. First to be eligible you must have filed your 2020 taxes.

Source: marca.com

Source: marca.com

So if you are a married couple filing jointly you will get one 600 California stimulus check but. CALIFORNIANS are getting two more rounds of stimulus checks before Christmas worth up to 1100 each. I dont know if Im going to get a Golden State Stimulus 2 or not. Next you must have a California adjusted gross income of 1 to 75000. More individuals will qualify for this program than the previous Golden State Stimulus I including individuals with adjusted gross income of at least 1 and up to 75000 per year.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

SACRAMENTO Tomorrow August 27 Californians will begin receiving the second round of Golden State Stimulus payments the historic 12 billion state tax rebate program enacted by Governor Gavin Newsom to provide direct relief for Californians hit hardest by the pandemic and support the states economic recovery. Federal IRS Stimulus Payment. AROUND 803000 more stimulus checks are going out to Californians this week - with the payments worth 563million in total. It is also not an unemployment insurance benefit. Every effort has been made to offer the most correct information possible.

Source: en.as.com

Source: en.as.com

California operates under a progressive tax schedule meaning the more you. California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. The GSS I payment is a different payment than the Golden State Stimulus II. California Golden State Stimulus payments and Federal Tax. 3 1200 payment to qualified ITIN filers who also qualified for CalEITC.

Source: marca.com

Source: marca.com

The requirements for the second Golden State Stimulus are based on the 2020 tax year. California stimulus check 2 is fully approved and the Golden State Stimulus 2 is coming in September. 2 days agoCALIFORNIANS can look forward to two more rounds of stimulus checks before the holidays. On November 29 California began to mail out 800000 paper checks under the Golden State Stimulus II. Contact us about the Golden State Stimulus Phone 800-852-5711.

Source: marca.com

Source: marca.com

Stimulus payments are not taxable. First to be eligible you must have filed your 2020 taxes. More Golden State Stimulus II money will be sent before the end of the year to eligible Californians. The latest batch of checks are part of the Golden State Stimulus II program. You may receive this payment if.

Source: the-sun.com

Source: the-sun.com

California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. I dont know if Im going to get a Golden State Stimulus 2 or not. California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. 3 1200 payment to qualified ITIN filers who also qualified for CalEITC. The second batch of Golden State Stimulus checks is on its way to Californians who qualify.

Source: marca.com

Source: marca.com

2 days agoCALIFORNIANS can look forward to two more rounds of stimulus checks before the holidays. There are currently two stimulus payments. Contact us about the Golden State Stimulus Phone 800-852-5711. On November 29 California began to mail out 800000 paper checks under the Golden State Stimulus II. 2 days agoCALIFORNIANS can look forward to two more rounds of stimulus checks before the holidays.

Source: pasadenastarnews.com

Source: pasadenastarnews.com

Golden State Stimulus I. California operates under a progressive tax schedule meaning the more you. Golden State Stimulus 2 Qualified Families and Individual residents of California will receive 600 to 1200. This is the second Golden State Stimulus aimed at Californians who have an annual income of less than 75000. The key details of the California stimulus check are that all those who make below 75000 will get one 600 stimulus check per tax return filed.

Source:

Source:

So if you are a married couple filing jointly you will get one 600 California stimulus check but. More Golden State Stimulus II money will be sent before the end of the year to eligible Californians. California operates under a progressive tax schedule meaning the more you. Visit Golden State Grant Program California Department of Social Services website for more information. 600 payments will be made to qualified taxpayers with a Social Security number an Adjusted Gross Income AGI between 1.

Source: marca.com

Source: marca.com

Check if you qualify for the Golden State Stimulus II. Help those facing a hardship due to COVID-19. On November 29 California began to mail out 800000 paper checks under the Golden State Stimulus II. There are currently two stimulus payments. The GSS I payment is a different payment than the Golden State Stimulus II.

Source: the-sun.com

Source: the-sun.com

This topic has 2 replies 2 voices and was last updated 3 days 3 hours ago by Maria Ku. 3 1200 payment to qualified ITIN filers who also qualified for CalEITC. Golden State Stimulus I. For most Californians who qualify you dont need to do anything to receive the stimulus payment. More individuals will qualify for this program than the previous Golden State Stimulus I including individuals with adjusted gross income of at least 1 and up to 75000 per year.

Source: americanpost.news

Source: americanpost.news

You can only receive this payment if you have received California Earned Income Tax Credit CalEITC or filed Individual Taxpayer Identification Number ITIN. More individuals will qualify for this program than the previous Golden State Stimulus I including individuals with adjusted gross income of at least 1 and up to 75000 per year. 600 payments will be made to qualified taxpayers with a Social Security number an Adjusted Gross Income AGI between 1. To qualify you must have. There are currently two stimulus payments.

Source: reddit.com

Source: reddit.com

Help those facing a hardship due to COVID-19. You can receive both this grant and the Golden State Stimulus if you qualify. 2 600 payment to qualified ITIN filers making 75000 or less. The GSS I payment is a different payment than the Golden State Stimulus II. The latest batch of checks are part of the Golden State Stimulus II program.

Source: honknews.com

Source: honknews.com

Contact us about the Golden State Stimulus Phone 800-852-5711. California Golden State Stimulus payments and Federal Tax. Here is everything you need to be or do to qualify for the second round of California stimulus checks. California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. Golden State Stimulus II eligibility.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs golden state stimulus 2 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.