Your What is supplemental add insurance images are ready. What is supplemental add insurance are a topic that is being searched for and liked by netizens today. You can Download the What is supplemental add insurance files here. Get all free vectors.

If you’re looking for what is supplemental add insurance pictures information related to the what is supplemental add insurance keyword, you have visit the right blog. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

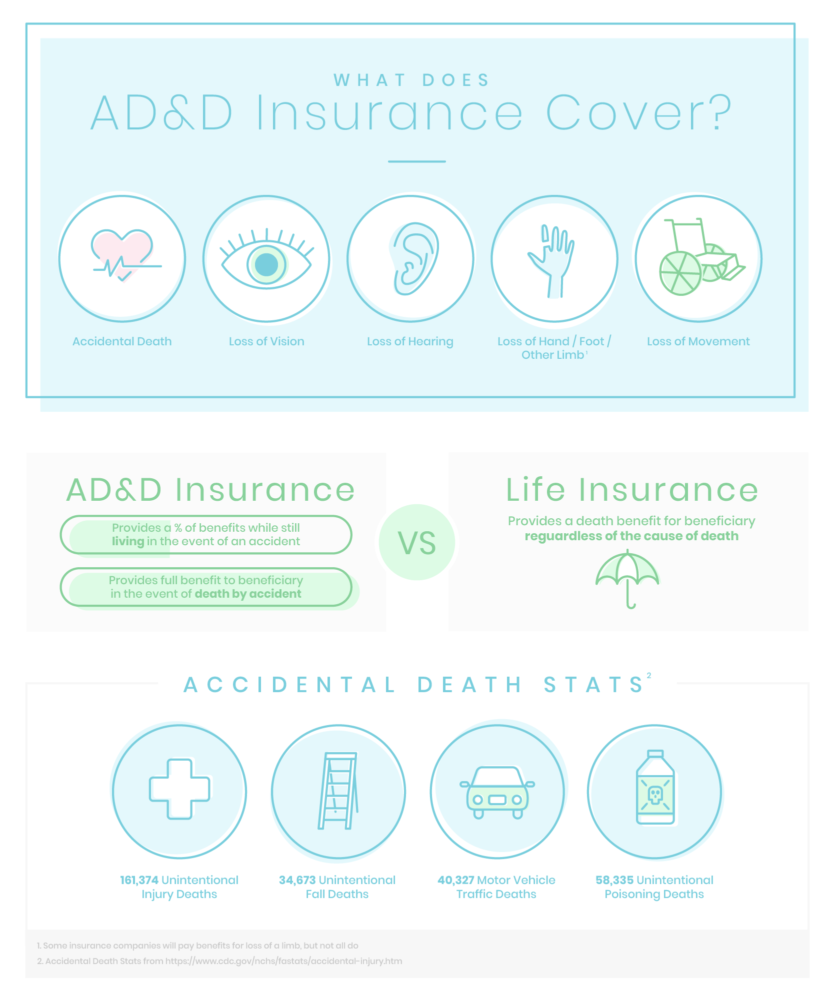

What Is Supplemental Add Insurance. Most people know about supplemental life and ADD Accident Death and Dismemberment Insurance but forget about supplement life insurance for a spouse or child. Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. It only covers accidents not natural death or injury from illness. We explain who its best for.

12 Ways To Save On Term Life Insurance Insurance Com Term Life Life Insurance Policy Insurance Marketing From in.pinterest.com

12 Ways To Save On Term Life Insurance Insurance Com Term Life Life Insurance Policy Insurance Marketing From in.pinterest.com

ADD can supplement life insurance because it will pay out if you lose a limb or eyesight or other non-death injuries covered by the policy. ADD insurance is not a replacement for life insurance. Supplemental life insurance is often offered by work but you can also buy direct. ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides. Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or. ADD insurance pays out if you die or are seriously injured in an accident.

Understanding its benefits and costs can help you decide whether buying supplemental ADD.

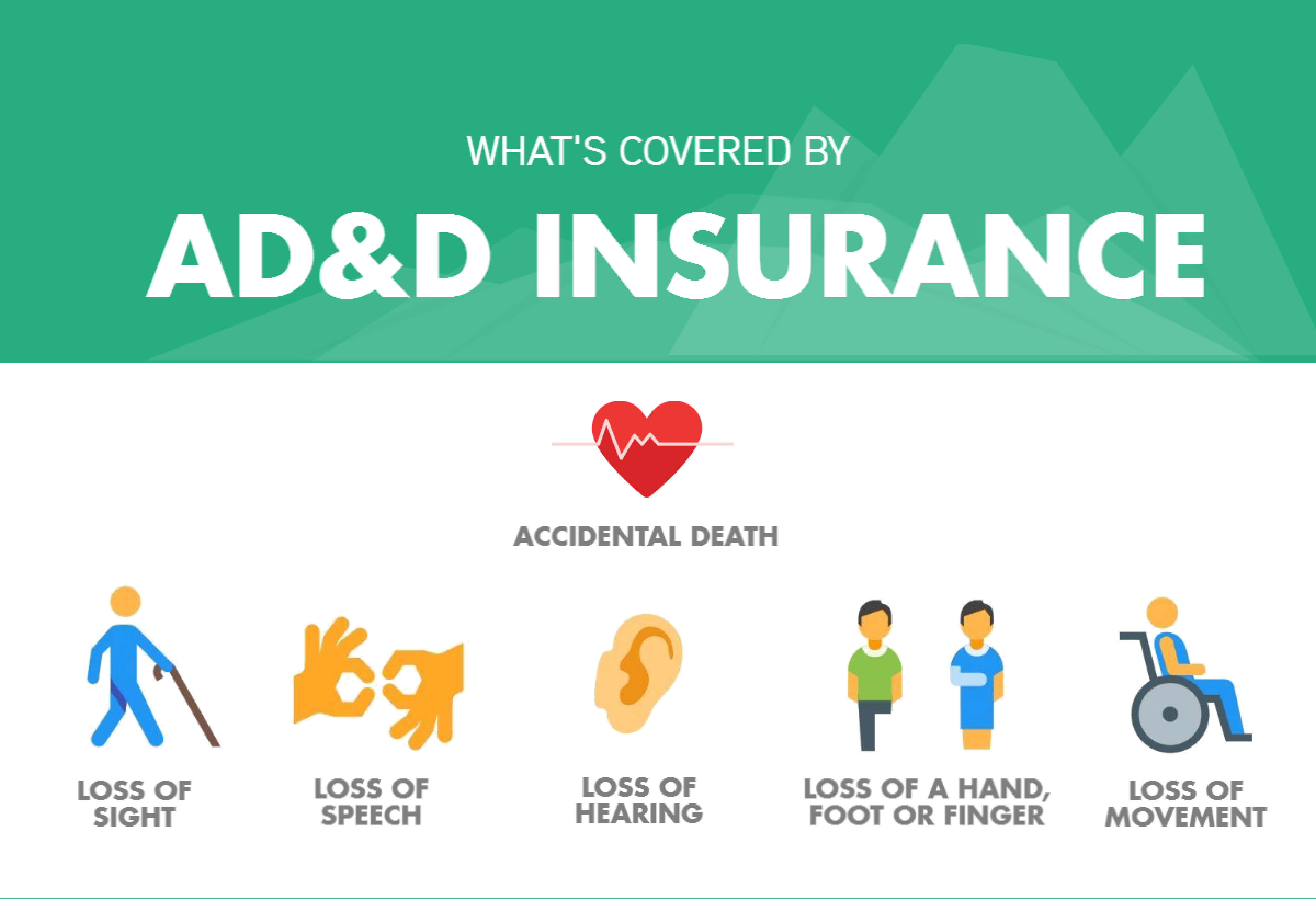

Accidental death and dismemberment ADD insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss of a limb due to an accident. AD D insurance pays benefits if you suffer a covered accident that results in paralysis or the loss of a limb speech hearing or sight or if you suffer a covered fatal accident. Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. Suicide or attempted suicide. Supplemental life insurance vs ADD Some employers offer supplemental benefits which can include life insurance. Understanding its benefits and costs can help you decide whether buying supplemental ADD.

Source: americanfidelity.com

Source: americanfidelity.com

Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. These policies may not require a medical exam and are given group rates based on age. Suicide or attempted suicide. It adds people or coverage to your policy. ADD insurance is not a replacement for life insurance.

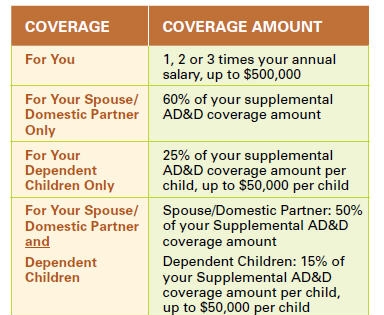

Source: sandiegocounty.gov

Source: sandiegocounty.gov

Most people know about supplemental life and ADD Accident Death and Dismemberment Insurance but forget about supplement life insurance for a spouse or child. The Pros and Cons of ADD. It adds people or coverage to your policy. The cost of this benefit is paid on an after-tax basis. Supplemental life insurance vs ADD Some employers offer supplemental benefits which can include life insurance.

Source: texasbar.memberbenefits.com

Source: texasbar.memberbenefits.com

It only covers accidents not natural death or injury from illness. Supplemental life insurance vs ADD Some employers offer supplemental benefits which can include life insurance. It can be an affordable way to supplement your life insurance or medical coverage if youre seriously injured or die as a result of an accident. However ADD coverage isnt nearly as robust as life insurance. Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or.

Source: pinterest.com

Source: pinterest.com

Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. These policies may not require a medical exam and are given group rates based on age. I didnt know this. ADD can supplement life insurance because it will pay out if you lose a limb or eyesight or other non-death injuries covered by the policy. ADD insurance can be a valuable and low-cost addition to your current benefits package.

Source: businessyield.com

Source: businessyield.com

It adds people or coverage to your policy. An accidental death and dismemberment ADD insurance policy can help protect your familys finances in the event of the loss of your life or limb s. An infection unless caused by an external wound accidentally sustained. The voluntary intake or use by. ADD insurance can be a valuable and low-cost addition to your current benefits package.

Source: seotoptoolz.com

Source: seotoptoolz.com

ADD insurance is not a replacement for life insurance. Suicide or attempted suicide. Supplemental life insurance is often offered by work but you can also buy direct. It adds people or coverage to your policy. However these policies often have some exclusions.

Source: glgamerica.com

Source: glgamerica.com

The Pros and Cons of ADD. ADD can supplement life insurance because it will pay out if you lose a limb or eyesight or other non-death injuries covered by the policy. Here are some common terms to look for. Supplemental Life Insurance Metlife. ADD insurance is not a replacement for life insurance.

Source: insurance.com

Source: insurance.com

An infection unless caused by an external wound accidentally sustained. The Pros and Cons of ADD. Understanding its benefits and costs can help you decide whether buying supplemental ADD. AD D insurance pays benefits if you suffer a covered accident that results in paralysis or the loss of a limb speech hearing or sight or if you suffer a covered fatal accident. The voluntary intake or use by.

Source: pinterest.com

Source: pinterest.com

Keep in mind ADD is not a substitute for. Accidents can happen in an instant but the consequences can last a lifetime. ADD insurance is not a replacement for life insurance. Spousal coverage elections cannot exceed 100 of the employee election amount ie employee elects 100000 for self spouse maximum is. An infection unless caused by an external wound accidentally sustained.

Source: pinterest.com

Source: pinterest.com

Employers often require you to buy a supplemental policy for yourself before being eligible for supplemental spouse or. It adds people or coverage to your policy. Its a limited accidental death and dismemberment ADD insurance policy. Suicide or attempted suicide. Keep in mind ADD is not a substitute for.

Source: quickquote.com

Source: quickquote.com

An accidental death and dismemberment ADD insurance policy can help protect your familys finances in the event of the loss of your life or limb s. ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides. Accidental death and dismemberment ADD insurance is an insurance policy that pays a death benefit upon the accidental death of an insured or upon the loss of a limb due to an accident. ADD can supplement life insurance because it will pay out if you lose a limb or eyesight or other non-death injuries covered by the policy. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or.

Source: pinterest.com

Source: pinterest.com

Even if its not an accident you cant be out sick beforehand. An employee must be enrolled in Supplement Employee ADD insurnace coverage to be eligible to enroll in Supplemental Dependent ADD insurance coverage. Supplemental ADD is a type of insurance that pays out clearly defined cash benefits if an accident causes death blindness or the loss of one or more limbs. What it seems to me is this supplemental insurance acts very much like ADD insuranceyou have to die while youre actively employed to get it. ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides.

Source: hub.jhu.edu

Source: hub.jhu.edu

ADD can supplement life insurance because it will pay out if you lose a limb or eyesight or other non-death injuries covered by the policy. The cost of this benefit is paid on an after-tax basis. The limits will depend on your particular policy. Accidental death and dismemberment ADD insurance gives your employees added financial security in sudden and tragic circumstances. If you can afford it ADD insurance should supplement your life insurance policy or you should add on an ADD rider.

Source: in.pinterest.com

Source: in.pinterest.com

ADD can supplement life insurance because it will pay out if you lose a limb or eyesight or other non-death injuries covered by the policy. ADD insurance pays out if you die or are seriously injured in an accident. An accidental death and dismemberment ADD insurance policy can help protect your familys finances in the event of the loss of your life or limb s. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or. Accidental death and dismemberment ADD insurance gives your employees added financial security in sudden and tragic circumstances.

Source: forbes.com

Source: forbes.com

Suicide or attempted suicide. Supplemental life insurance vs ADD Some employers offer supplemental benefits which can include life insurance. It can be an affordable way to supplement your life insurance or medical coverage if youre seriously injured or die as a result of an accident. An infection unless caused by an external wound accidentally sustained. We explain who its best for.

Source: investopedia.com

Source: investopedia.com

Here are some common terms to look for. The limits will depend on your particular policy. Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. Suicide or attempted suicide. The cost of this benefit is paid on an after-tax basis.

Source: pinterest.com

Source: pinterest.com

Most people know about supplemental life and ADD Accident Death and Dismemberment Insurance but forget about supplement life insurance for a spouse or child. If you can afford it ADD insurance should supplement your life insurance policy or you should add on an ADD rider. Supplemental Life Insurance Metlife. It only covers accidents not natural death or injury from illness. Supplemental life insurance is similar to a group term life insurance policy but is typically more limited.

Source: termlife2go.com

Source: termlife2go.com

Supplemental life insurance is often offered by work but you can also buy direct. Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident. While an ADD policy provides benefits to your beneficiaries when you die the caveat. Supplemental life insurance is similar to a group term life insurance policy but is typically more limited. What it seems to me is this supplemental insurance acts very much like ADD insuranceyou have to die while youre actively employed to get it.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is supplemental add insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.